Paying for medication at a pharmacy is a more complicated process than what meets the eye. The cost varies due to the medication and whether the patient is insured or not along with how the insurance company covers the specific medication. To help simplify it, we have broken down what an insured patient may pay for medication into a few categories, and also establish how an insurance company typically determines the price for the medication in the first place.

How is the Cost Determined?

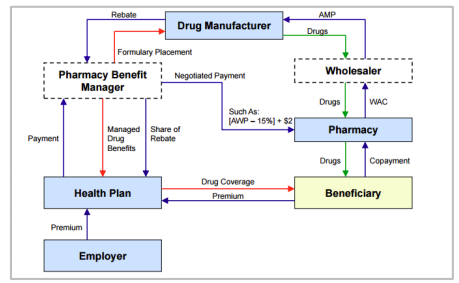

To figure out how the cost for medication is determined, you need to know how the supply chain works and how PBMs and employer sponsors tie into the process. Here is what a typical supply chain looks like.

Drug Supply chain and payment tracking

Supply Chain for a Pharmacy

The supply chain for a pharmacy is similar to a regular supply chain with one key difference. There is a middle-man that does not ever actually touch the medication, a PBM – pharmacy benefit manager. Their role is to negotiate the costs with the manufacturer on behalf of many Health Plans representing millions of people.

A PBM negotiating with manufacturers on behalf of millions of patients to get patients the best medications at the lowest prices should be a good thing right? In practice, however, PBMs are incentivized more heavily on the discount received from a manufacturer than they are on the lowest final cost to the patient. This means that the PBM will come out better if they negotiate a higher price for the medication with a larger discount, which ultimately means that the cost to the patient gets inflated instead of reduced.

Another big problem with this model is that the retailer, in this case the pharmacy, does not have a choice in what the patient pays for the medication, nor do they have a choice in what the pharmacy pays the wholesaler for the medication.

Now, let’s dive a bit more into the pricing process.

Pricing Process

The typical pricing process for a medication is as follows.

- The manufacturer will establish a list price for the medication. For this example, we will say that the price for the medication is $1,000.

- The PBMs will negotiate with the manufacturer to establish a rebate or discount. The rebate will be paid by the manufacturer to the PBM. After negotiating with the manufacturer, the PBM has been able to establish a rebate of $450.

- The PBM will then take a small part of that rebate, which in this case we will say is $100, for their services, and send the other $350 to the patient's Health Plan.

One thing to note is that these rebates also tie into what tier the medication will be on the patient's insurance plan. If a manufacturer wants to get their medication on a better preferred plan, the manufacturer can increase the list price and increase the discount paid to the PBM. This works out fine if you have a very good health insurance plan, but it negatively affects people with high-deductible plans, self-pay patients, and pharmacies.

The interesting thing here is that the wholesaler, nor the pharmacy have any say in what the patient pays for the medication. A standard supply chain allows the wholesaler and the retailer to decide what they can sell the product for and thereby use good business practices to drive the prices down. That is not how it works in a pharmacy though.

Instead, the pharmacy will purchase their medication from the wholesaler on a completely different pricing strategy. Instead of being based on the list price that the manufacturer established, it is usually based off of the wholesaler acquisition cost, which is typically lower than the list price, and the pharmacy has to take whatever payment the PBM decides to give them.

Let's switch gears here and talk about categories of coverage.

Categories of Coverage

There are essentially 4 different categories a patient may fall under as an insured patient. These categories are Covered (deductible met), Covered (deductible not met or high deductible), Not Covered, and Pharmacy Discount Card (cash pay).

Covered (Deductible Met) Medication

This category is what most people think of when they are going to the pharmacy, have insurance, and need to pick up their prescription. Typically this plan will divide their medications by tiers.

- Tier 1 will have a price of say $15 that they pay for any generic medication and $40 for any brand medication. When this is the case the patient is usually satisfied with their cost experience. However often this is not the case.

- Tier 2 might be $25 for a generic medication and $60 for Brand.

- Tier 3 can often be closer to the full cost of the medication. Say $150 for generic and $600 for brand.

Covered (Deductible Not Met/High Deductible)

Most patient’s insurance plans require them to pay a significant portion of their medication out of pocket before their insurance company will begin to pay. This means that the patient will pay the listed price for the medication that the PBM negotiated. Using our example that we discussed earlier, the patient will end up paying $1000, and $450 of those dollars will go back to the PBM who will then send $400 to the insurance’s plan employer-sponsor. That money should be going back to reduce the patient’s cost, but they probably won’t ever notice it because of the complicated system and cost sharing. Which should be money going back to reduce the patient's cost, but I doubt that patients will feel like it is reducing their cost, I know I wouldn’t.

Medication is Not Covered

The reason for a medication not being covered is usually due to the PBM deciding not to cover it and instead cover another medication that is in the same class. In these instances, rather than paying the negotiated list price, which is what happens with a high deductible plan, the patient will end up likely paying significantly more than the listed price.

A pharmacy will have a specific amount that they request from each insurance company for the requested payment, and this number will typically be significantly more than any insurer will reimburse them at. This is because every insurer will repay the pharmacy at a different price (and these prices generally only go lower, never higher) and if the pharmacy does not submit a price at or above what the insurer will reimburse them at, they will get underpaid. Rest assured the PBM's know how much the medication costs the pharmacy and will pay as little as they can get away with for the medication.

If your pharmacy is watching out for the patient though, they will see that the claim is not covered and offer to either put the patient on a self-pay discount card or talk to their doctor to change the medication to one that is on their insurance formulary.

Pharmacy Discount Card/Cash Pay

A patient may be able to obtain a medication at a lower price with a pharmacy discount card/cash pay. The reason for this is because a discount card is typically priced with the more traditional pricing chain model. The price is based on what the pharmacy pays for the medication from the wholesaler, and marking it up enough for the pharmacy to still make a profit and stay in business. For example, a manufacturer and a PBM driving up the price of a medication to achieve better rebates and preferred formulary status.

We hope that this information has helped you gain a better understanding of how pricing works for medication through health plans! As health care providers, we always aim to help lower costs for patients rather than help the middle-men pull out more healthcare dollars and inflate patient healthcare costs. For more information, check out this in-depth article from The American Health Policy Institute.